Financial Planning

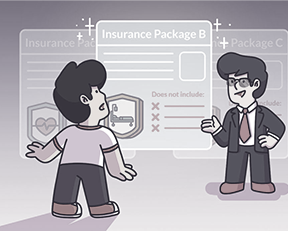

Is More Insurance Always A Good Thing?

Do you know what your Integrated Shield Plan and rider cover, and how much they cost?Speak to your financial advisor to review and right-size your coverage to fit your needs!This post is sponsored by Ministry of Health Singapore.

16 Oct 2025

READ MORE0

Debunking the ‘Buy More Insurance While You’re Young’ Misconception

14 Oct 2025

0

ETFs Explained: Because You Don’t Need to Be A Finance Bro To Invest

08 Oct 2025

0

Chasing The 5Cs Left Me Tired And Miserable

07 Oct 2025

0

Go Big Or Keep It Small?

03 Oct 2025

0

5 Questions To Ask Yourself Before Taking A Personal Loan

30 Sep 2025

0

I Bought My First Luxury Watch Thinking I Could Afford It, Only To End Up With Very Tight Cashflow

29 Sep 2025

0

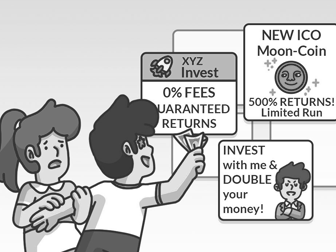

New To Investing? Here Are Some Power Moves

24 Sep 2025

0

Tie The Knot Like A Star, Without The ‘Celebrity’ Price Tag

23 Sep 2025

0

How I’m Protecting My Money In Uncertain Times

22 Sep 2025

0

SUBSCRIBE

STAY UPDATED!

And join our community© Copyright 2025 The Simple Sum. All Rights Reserved.