Understanding fixed vs floating home loans

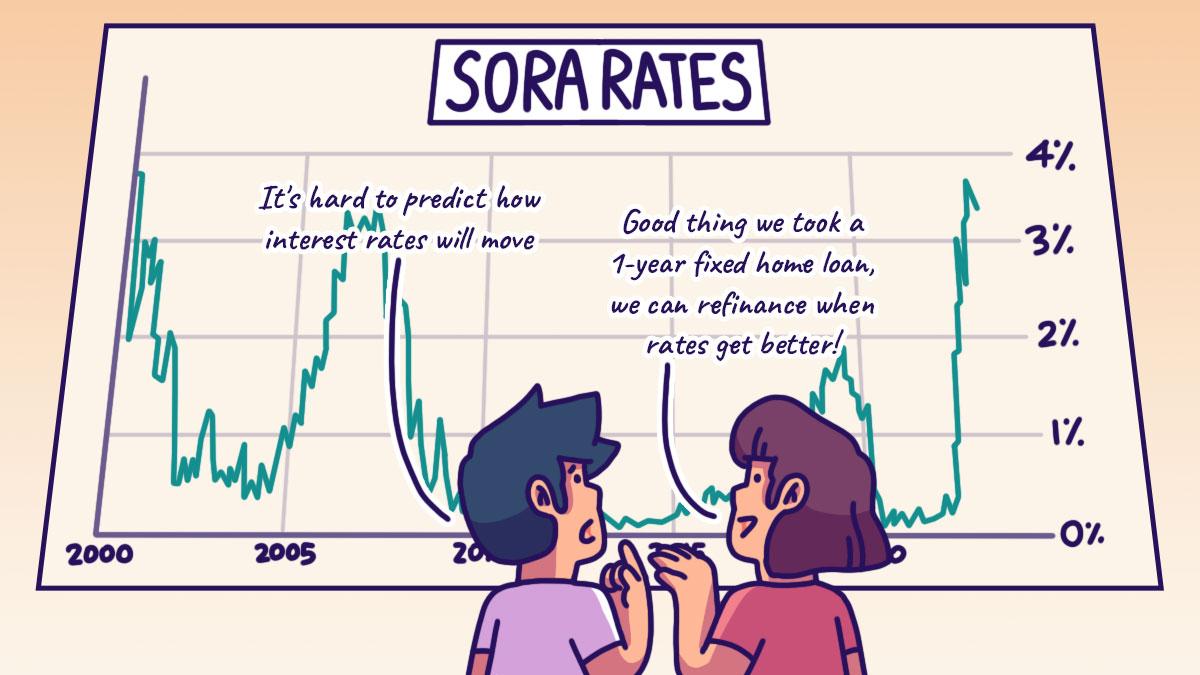

Typically, there are two types of home loans offered in Singapore: fixed rate home loans and floating rate home loans. A fixed rate home loan, as the name implies, has a fixed interest rate that doesn’t change during the lock-in period, which typically range between two to five years. If you prefer certainty in how much you would pay for your home loan every month, a fixed rate home loan would give you just that. This gives you better control over your monthly budget, and if interest rates do still go up, you’ll be protected against the hike for the duration of the lock-in period. But the reverse is also true, if interest rates drop, you may be paying rates higher than the market. On the other hand, a floating rate home loan has a variable interest rate. This type of home loan is tied to a reference rate such as the Singapore Overnight Rate Average (SORA) or Singapore Interbank Offered Rates (SIBOR). These reference rates can increase or decrease and tend to move in tandem with market conditions. For example, SIBOR and SORA rates went up quickly in 2022, alongside the series of interest rate hikes made by the Federal Reserve. So what does this mean for those who take a floating rate home loan? If you have a SORA-pegged home loan and the SORA rates go up, so does your monthly repayment amount. Floating home loans are an option to consider if you’re comfortable with handling changes to your monthly mortgage repayments. And the key advantage is that you could be paying less the following month if your mortgage interest rate dips. For Clement and his wife, they first got a floating-rate home loan with a 2-year lock-in period in 2020 as interest rates were near-zero. When interest rates were at their lowest point, his mortgage rates were about 1.25% p.a. But as interest rates hiked up in 2022, the couple found they were paying a mortgage rate of 4.85% p.a., forking out $3,447 a month!

As they were reaching the end of their lock-in period in late 2022, they started exploring the available loan options available to them and found a suitable refinancing option.

And because he refinanced his home loan, he is now paying a loan with an interest rate of 3.35% p.a. His monthly instalments have gone down considerably and are now $2,711 per month. By refinancing his home loan, Clement saved himself $736 a month. Imagine if he had not refinanced his home loan!

For Clement and his wife, they first got a floating-rate home loan with a 2-year lock-in period in 2020 as interest rates were near-zero. When interest rates were at their lowest point, his mortgage rates were about 1.25% p.a. But as interest rates hiked up in 2022, the couple found they were paying a mortgage rate of 4.85% p.a., forking out $3,447 a month!

As they were reaching the end of their lock-in period in late 2022, they started exploring the available loan options available to them and found a suitable refinancing option.

And because he refinanced his home loan, he is now paying a loan with an interest rate of 3.35% p.a. His monthly instalments have gone down considerably and are now $2,711 per month. By refinancing his home loan, Clement saved himself $736 a month. Imagine if he had not refinanced his home loan! Consider the interest rate outlook

Clement and his wife chose to go with a fixed-rate home loan when they refinanced their mortgage as they felt that it would “curb our long-term risk, while remaining competitively priced after considering the mortgage interest rate outlook for 2023”. Market factors suggest that the chances of mortgage rates going down in the next couple of months are low. In fact, it is predicted that interest rate hikes will only moderate in H2 2023. This can be attributed to the following reasons:- In 2023, mortgage rates are expected to remain high but the Federal Reserve rate hikes are expected to be less aggressive

- In September 2022, the Monetary Authority of Singapore (MAS) raised the interest rate used to calculate the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) up from the previous 3.5% to the current 4% for residential property loans.