Why does that matter to me?

Stress can have some pretty serious long-term effects on your health. Left unaddressed, it can lead to chronic fatigue, constant irritability, and the inability to sleep and concentrate. But the effects of stress don’t just stop there – left unchecked, stress can also begin to affect our personal lives and relationships, and even become a real threat to our careers and livelihoods. So, what can we do to help reduce financial stress? There are a few things you can do, but they all involve taking control of your finances in a tangible and disciplined way.Figure out where your financial stress is coming from

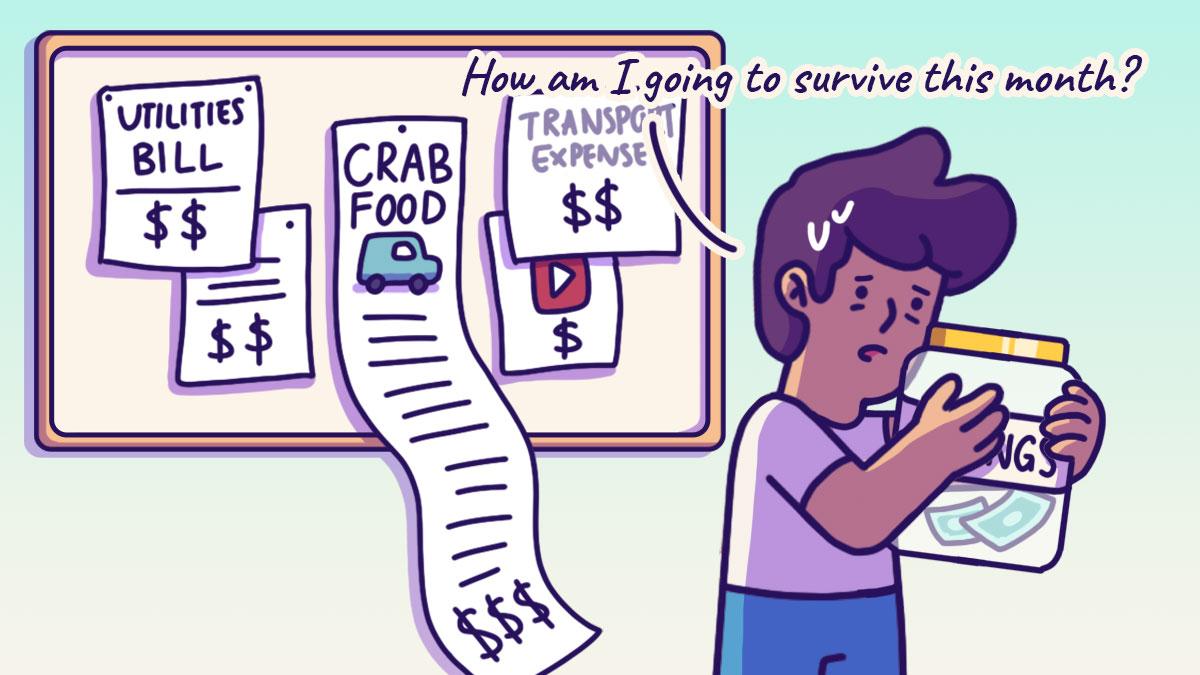

The first step to alleviating your anxiety and stress is to figure out what’s causing that stress in the first place. Are you constantly worried about running out of money before the end of the month? If the answer is yes, then it might be time to take a closer look at your budget and spending habits. That means getting real with yourself and tracking your expenses more closely – no more ignoring those bank statements! It helps to set a budget for yourself that’s realistic and that allows you to save a bit each month. And if you’re really struggling to make ends meet, you can consider finding ways to earn more money. This can mean asking for a raise or even finding a new job with better pay. For some, the anxiety comes from worrying about not having enough money for the future, instead of right now. In that case, setting concrete goals and financial milestones helps you feel more in control and ensures you’re on track to meeting your savings target. Also consider your existing financial obligations and decide what you can cut out. Do you really need all those subscriptions to platforms that provide the same service or could you do with less? Cutting out unnecessary expenses can lighten the pressure on your budget, giving you some much-needed breathing room and less stress.Emergency funds are key to reducing some of your stress

Speaking of uncertainty, one way to make sure you’re not stressing out too much over what might happen to you is to build up a healthy emergency fund. This is money you’re setting aside specifically for those unexpected emergencies and large expenses to meet an urgent need that can really throw a wrench in your finances.

Having an emergency fund in place takes a huge weight off your shoulders and gives you peace of mind. The rule of thumb is to have an emergency fund of six times your monthly living expenses—just enough to keep you secure, in the event you suddenly lose your job or find yourself facing a costly emergency.

Knowing you have a safety net to fall back on makes all the difference in reducing your financial stress levels.

Speaking of uncertainty, one way to make sure you’re not stressing out too much over what might happen to you is to build up a healthy emergency fund. This is money you’re setting aside specifically for those unexpected emergencies and large expenses to meet an urgent need that can really throw a wrench in your finances.

Having an emergency fund in place takes a huge weight off your shoulders and gives you peace of mind. The rule of thumb is to have an emergency fund of six times your monthly living expenses—just enough to keep you secure, in the event you suddenly lose your job or find yourself facing a costly emergency.

Knowing you have a safety net to fall back on makes all the difference in reducing your financial stress levels.