What is FIRE, and how does it work?

FIRE was made popular by money concepts introduced by two books; “Your Money or Your Life” by Vicki Robin and Joe Dominguez and “Early Retirement Extreme” by Jacob Lund Fisker. The idea behind F-I-R-E is simple, if you have enough net worth, you can quit your job before the traditional retirement age. But to succeed in building wealth in the shortest time would mean that you have to work very hard, live in extreme frugality and get very high returns on your investments.Is FIRE possible? Yes, it is!

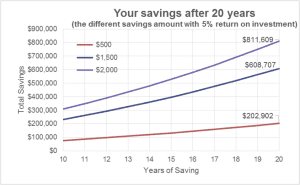

Mathematically, FIRE is possible! Let’s say, you plan to retire in 20 years and your F-I-R-E number (the amount of money invested for you to live off the returns and quit working) is $2,000,000. Every month you have to save $5,000 and invest the money in investments that give you a 5% return every year. By reinvesting your 5% return, you can snowball your wealth exponentially. In 20 years, you can quit your job and enjoy your $2,000,000 retirement stash. But, if every month you can only save $2,500, you have to invest in higher returns investments to reach your F-I-R-E number goal. The math is quite simple, the less you can save every month, the higher the investment return that you will need. To successfully F-I-R-E, you need to spend as little as possible and get investment returns as high as possible.Beware of the F-I-R-E pitfalls

Now that you understand F-I-R-E and know that it is mathematically possible before you start your journey, it’s worthwhile to stay alert to some things that may go wrong. There are pitfalls you have to watch out for and avoid at all costs because they can have repercussions on you, not just financially, but emotionally and mentally.Extreme frugality and side hustling for 20 years, can you, do it?

The first important step for F-I-R-E is to build as much investment capital in the shortest time possible. There are two ways to do it; spend less and earn more. For the average salary-earning person, the only way to save more is by keeping your expenses as low as possible. The F-I-R-E movement recommends saving up to 50-70% of monthly income. If you want to speed up your F-I-R-E, you are encouraged to hustle for more income at the side. Living frugally and using every waking hour to make more money can be harsh and you risk burning out mentally, emotionally and physically.Taking high investment risks to achieve unrealistic investing goals

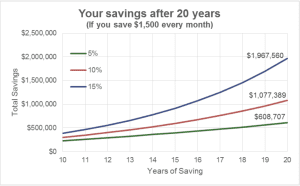

To succeed in F-I-R-E you have to aggressively build your retirement nest egg in a relatively short period which the normal retirement investing strategy is not enough because they are lower-risk with lower returns. Especially for lower-income adults, because they can only save a small monthly amount (no matter how hard they try) and they aggressively invest in high-yield Investments with higher risks.

To succeed in F-I-R-E you have to aggressively build your retirement nest egg in a relatively short period which the normal retirement investing strategy is not enough because they are lower-risk with lower returns. Especially for lower-income adults, because they can only save a small monthly amount (no matter how hard they try) and they aggressively invest in high-yield Investments with higher risks.

If you go back to our earlier F-I-R-E number of $2,000,000 example, for someone who earns $2,500 a month it is impossible to save $5,000. Even if you save $2,000, which is 80% of your salary, a 5% return investment will only add up to $1,000,000 in 20 years!

Therefore, to achieve your F-I-R-E number, you have to invest in higher yield investments which usually come with higher risks, and you could end up losing your savings if the investments go bad.

If you go back to our earlier F-I-R-E number of $2,000,000 example, for someone who earns $2,500 a month it is impossible to save $5,000. Even if you save $2,000, which is 80% of your salary, a 5% return investment will only add up to $1,000,000 in 20 years!

Therefore, to achieve your F-I-R-E number, you have to invest in higher yield investments which usually come with higher risks, and you could end up losing your savings if the investments go bad.

F-I-R-E blind spots

When you are driving, if there’s a car in your blind spot (you cannot see the car coming) and you swerve suddenly to avoid the car, there’s a good chance you’ll get into an accident. Similarly, in F-I-R-E planning, there are blind spots (the unknown and unpredictable) that can derail your plans if you aren’t prepared for them. Here are some F-I-R-E blind spot examples:- Do you know how to invest, or do you just follow the crowd? The financial markets are full of unpredictable events and prices of investments can swing very wildly, if you do not have basic investing knowledge, it is easy to make mistakes and lose your savings. Because investing is the F-I-R-E core principle in growing your money, you need to spend enough time learning and understanding investing.

- Economies and financial markets move up and down in cycles. If you have invested in down-trending markets, you are not likely to meet your F-I-R-E number as planned. Researching and understanding what you are investing in is the key to successful investing

- Inflation is the biggest enemy in retirement planning and savings because inflation reduces the value of your money. By the time you reach your F-I-R-E goal, your planned F-I-R-E number could have lost much of its value, and you may not have enough to retire early. To keep pace with inflation, instead of sticking to a fixed monthly amount, you have to increase accordingly with inflation.

- There are many instances when close ones (family and spouse) are supportive of F-I-R-E, it can cause a lot of friction in your family life. Before you take on the F-I-R-E challenge, it helps to discuss your plans with your family and try to gain their emotional and mental support.