Investing can seem intimidating when you are just starting.

There’s so much jargon and so many concepts to understand. What’s a P/E ratio? How does a mutual fund differ from an ETF? And what on earth is a custodian account?

Not to mention, there are so many investment instruments and platforms to choose from. Should you go with stocks, bonds, or maybe real estate? And which platform is the best?

That's exactly why we created this guide — we’ll explore various investment options in Singapore, what they are, and what you need to know to get started investing in them.

But before diving into the specific investment options, let's cover some essential principles that every investor should understand.

Why it’s important to start investing—and start early

When it comes to investing, time is one of your most valuable assets.

The earlier you start, the more time your money has to grow. This is due to the power of compounding, where the returns you earn on your investments start generating their own returns.

Over time, this compounding effect can lead to exponential growth in your investment portfolio.

Starting early also allows you to take advantage of long-term market trends.

Markets may fluctuate in the short term, but historically, they tend to rise over the long term.

By starting your investment journey early, you give yourself more time to ride out market volatility and benefit from overall growth.

Additionally, starting early means you can afford to start small and gradually increase your investments as your financial situation improves. This approach makes investing less daunting and more manageable, especially for beginners.

Every investment has its risks and rewards

Investing always involves a trade-off between risk and return.

Generally, the higher the potential return on an investment, the higher the risk that comes with it. This principle is foundational to making informed investment decisions.

For instance, stocks are known for their potential to generate high returns, but they also come with higher volatility compared to more stable investments like bonds or savings accounts.

On the other hand, government bonds offer lower returns but come with much lower risk, making them suitable for conservative investors.

Understanding your own risk tolerance—how much risk you’re comfortable taking on—is crucial.

Are you willing to endure short-term losses for the possibility of higher long-term gains, or do you prefer the security of lower but more stable returns? Your risk tolerance will influence your investment choices and help you build a portfolio that aligns with your financial goals.

Diversify your investments

Diversification is a risk management strategy that involves spreading your investments across different asset classes, industries, or geographic regions. The idea is simple: don’t put all your eggs in one basket.

By diversifying, you reduce the risk that a poor performance in one investment will significantly impact your overall portfolio. For example, if you only invest in stocks of a single company and that company performs poorly, your entire investment could suffer.

But if you diversify by investing in stocks across different industries, bonds, and perhaps some real estate, the underperformance of one investment can be offset by the gains in another.

Diversification not only helps manage risk but also allows you to tap into multiple sources of potential returns. It’s an essential strategy for building a resilient investment portfolio that can weather market ups and downs.

Have a long-term mindset

Investing is not about getting rich quickly; it’s about growing your wealth steadily over time.

A long-term mindset is crucial for several reasons. First, it helps you stay focused on your financial goals, even when markets are volatile. Second, it allows you to take full advantage of the power of compounding.

Compounding occurs when the returns on your investments generate their own returns.

For example, if you invest $1,000 and earn a 10% return, you’ll have $1,100 at the end of the year. If you reinvest that $100 and earn another 10% the next year, you’ll end up with $1,210, and so on. Over time, compounding can turn even modest investments into significant wealth.

However, to fully benefit from compounding, you need to give your investments time to grow. This means being patient and staying the course, even when markets experience downturns. Remember, market fluctuations are normal, and having a long-term perspective can help you avoid making rash decisions based on short-term events.

Exploring your investment options in Singapore

Now that you understand the importance of starting early, the risk-return trade-off, diversification, and having a long-term mindset, let’s dive into the different investment options available to you in Singapore.

Whether you prefer the growth potential of stocks and ETFs, the stability of government bonds, or the convenience of mutual funds and robo-advisors, there’s an investment path that’s right for you.

Investment Option 1: Stocks

Stocks represent ownership in a company. When you buy a stock, you are essentially buying a tiny piece of that company, known as a share.

As a shareholder, you participate in the company's profits and losses and might even receive dividends if the company distributes them.

You can invest in stocks listed on the Singapore Stock Exchange (SGX) or on exchanges in other countries, such as the New York Stock Exchange (NYSE) or NASDAQ.

For example, companies like DBS, OCBC, and SingPost are listed on the SGX.Investing in stocks requires homework. You will need to research the companies you’re interested in, understand their business models, and monitor their performance over time.

This can be exciting but also requires a commitment to staying informed about market trends and company news.

The minimum investment for most stocks is 100 shares in Singapore. So, if a share costs $1.00, you’d need at least $100 to get started.

Keep in mind that stock prices vary widely—some stocks might cost a few dollars per share, while others can cost several hundred dollars per share.

How to buy stocks

You can buy stocks through various broker platforms in Singapore.

Here’s a list of some popular brokers in Singapore where you can buy stocks:

- DBS Vickers

- Maybank

- Kim Eng Securities

- OCBC Securities

- Moomoo

- Tiger Brokers

- Webull

- SAXO

- CMC Invest

- Interactive Brokers

- City Index

- CGS International Securities

- FSMOne

- Phillip Securities (POEMS)

Each broker offers different features and charges varying fees, so it’s important to compare them and choose one that fits your needs. Some may have lower trading fees, while others might offer better research tools or customer support.

To invest in Singapore stocks, you’ll also need to open a Central Depository (CDP) account or a custodian account. A CDP account directly holds your shares, while a custodian account holds them on your behalf. Non-Singapore stocks, such as US stocks, are typically held in a custodian account.

Investment Option 2: Singapore Savings Bonds

Singapore Savings Bonds (SSBs) are a type of government bond issued by the Monetary Authority of Singapore (MAS). They offer a safe and flexible way for individuals to invest their money.

Backed by the Singapore Government, SSBs are designed to be a low-risk investment option suitable for conservative investors who prioritize preserving their capital and getting stable returns.

SSBs have an investment tenure of up to 10 years, and the interest rates increase the longer you hold them.

You can also choose to exit your investment in any given month without facing any penalties. This means you don’t have to lock in your money for a specific period from the start.

The minimum investment amount for SSBs is $500, and you can invest in multiples of $500 thereafter. This low entry point makes it accessible to a wide range of investors.

How to Buy SSBs

First, you need a Central Depository (CDP) account, which will hold your SSBs. If you don’t already have one, you can open it easily through your bank.

Then, you can purchase SSBs through any of the three local banks in Singapore—DBS/POSB, OCBC, or UOB. The process can usually be done online via the bank's internet banking platform, at ATMs, or by visiting a branch.

Investment Option 3: Singapore Government Securities

Singapore Government Securities (SGS) are bonds issued by the Singapore Government to finance its expenditures and support market development.

These bonds are fully backed by the Singapore Government, making them a secure investment option.

SGS bonds provide a steady stream of income through regular interest payments, known as coupons, at regular intervals (usually semi-annually) until the bond matures.There are three main categories of SGS bonds: SGS Market Development, SGS Infrastructure, and Green SGS Infrastructure.

SGS bonds have a wide range of investment tenors, from as short as two years to as long as 50 years. This flexibility allows you to choose a bond that aligns with your investment horizon.

The minimum investment amount for SGS bonds is $1,000, and you can invest in multiples of $1,000 thereafter.

How to invest in SGS Bonds

To hold SGS bonds, you’ll need a Central Depository (CDP) account. There are two ways to invest in SGS Bonds, primary market (new issues), or secondary market (existing issues).

Primary Market (New Issues)

You can bid for new SGS issues during primary auctions. To do this, submit a bid through one of the three local banks—DBS/POSB, OCBC, or UOB.

Secondary Market (Existing Issues)

If you want to buy existing SGS bonds, you can do so on the secondary market through a broker. This method allows you to purchase bonds that are already in circulation.

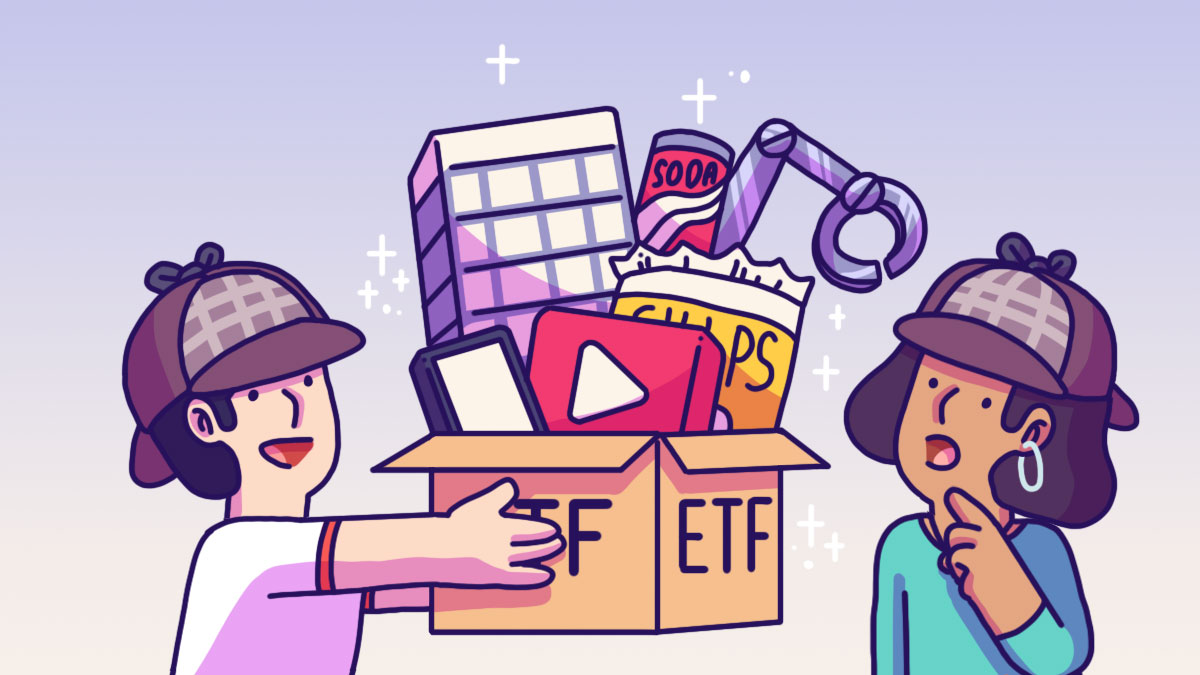

Investment Option 4: Exchange-traded funds (ETFs)

Exchange-traded funds, commonly known as ETFs, are investment funds that are traded on stock exchanges, much like individual stocks. Each ETF holds a collection of different assets, like stocks, bonds, or commodities, and aims to track the performance of a specific index or sector.

One of the biggest benefits of ETFs is diversification. When you buy an ETF, you’re essentially buying a basket of stocks or other assets. This means your investment is spread across multiple companies or sectors, reducing the risk of any single asset affecting your overall investment.

If you’re not comfortable or don’t have the time to research and pick individual stocks, ETFs offer a convenient alternative.

There is no minimum investment amount, which means you can start by buying just one unit of an ETF. Some brokers even offer fractional shares, allowing you to invest as little as $1.

How to Buy ETFs

You can buy ETFs on a stock exchange such as the Singapore Exchange (SGX).

The process for buying Singapore-listed ETFs is similar to buying individual stocks. You’ll need to open a Central Depository (CDP) account or a custodian account, along with a brokerage account.

For ETFs listed outside of Singapore, such as those on US exchanges, you will need a custodian account, where the broker holds the shares on your behalf.

Investment Option 5: Investment funds

Investment funds are financial vehicles where money from many individual investors is pooled together to create a large fund.

This fund is then invested and managed by professional portfolio managers. By investing in an investment fund, you get exposure to a wide range of asset classes, including equities, bonds, and fixed income instruments, without needing to manage the investments yourself.

Investment funds are ideal for those who prefer a hands-off approach to investing. Once you invest your money, professional fund managers handle all the research, investment selection, buying, and selling of securities to meet the fund's objectives.

The aim is to achieve the best possible returns while managing risk, saving you the time and effort required for individual stock or bond selection.

Many investment funds have relatively low minimum investment requirements, making them accessible to a wide range of investors. For instance, you can start investing in some funds through a regular savings plan starting from just $100.

How to buy investment funds

There are a few ways to access investment funds including buying through banks, investing through a robo-advisor, or buying with a broker.

Banks

You can invest in funds by buying unit trusts or getting a regular savings plan (RSP) through your bank. This is a convenient option as banks often provide various funds managed by reputable asset management companies.

Robo-Advisor

Robo-advisors are online platforms that create a portfolio of ETFs or funds tailored to your risk tolerance and investment goals. They automate the investment process, making it easy and cost-effective for investors to get started.

Brokers

You can also buy into funds directly through a broker. Many brokers offer a wide selection of funds, allowing you to choose those that best fit your investment strategy.

Start your investing journey with confidence

Investing in Singapore doesn’t have to be complicated. With a clear understanding of the various options available and the steps to get started, you can embark on your investment journey with confidence and clarity.

Whether you prefer the safety of government bonds, the potential growth of stocks and ETFs, or the convenience of mutual funds and robo-advisors, there’s an investment path that’s right for you.

This content is part of the Temasek – Financial Times Challenge, a financial literacy education series in Singapore for youths.