What are credit card rewards?

Credit card rewards come in three main forms: cashback, points and miles. Cashback is as straightforward as it gets. Spend money, and you get a small percentage back. It’s like a mini refund on everything you buy, which you can often use to offset your credit card balance. Simple and practical. Miles cards are a favourite among frequent travellers. If you’re on a frequent flyer program, you can accumulate miles based on your spending, which you can then redeem for flights and upgrades. However, you need to keep track of your miles to ensure you use them for flights before they expire, and you may not be able to redeem business or first-class awards for popular destinations like London. Points offer more variety and flexibility. With points, you can choose from a wide range of rewards, including travel (they can be converted to miles), merchandise, gift cards, and even experiences. The beauty of points is in their versatility—they can be whatever you want them to be, whether it’s a hotel stay or the latest tech gadget.Understanding the value of your points

Not all points are created equal. Their value changes depending on how you choose to redeem them. To ensure you’re getting the best deal, here are some strategies you can implement:Know what you want to buy

Start with a clear goal. Whether you’re eyeing a new laptop, a trip to Tokyo, or just a fancy night out, know what you want to redeem your points for.Prioritise rewards that fit your lifestyle

Remember, it’s not just about extracting the maximum value from your points; it’s about how these points can add value to your life. If you’re frustrated with being waitlisted for flights, you can use your points to offset your travel purchases and unlock the flexibility and convenience you desire. If you’re someone who doesn’t travel often, you can use your reward points to purchase items to upgrade your lifestyle. You could be in the market for a cordless vacuum cleaner to replace your bulky one, why not use your points while you’re at it?Explore the rewards marketplace

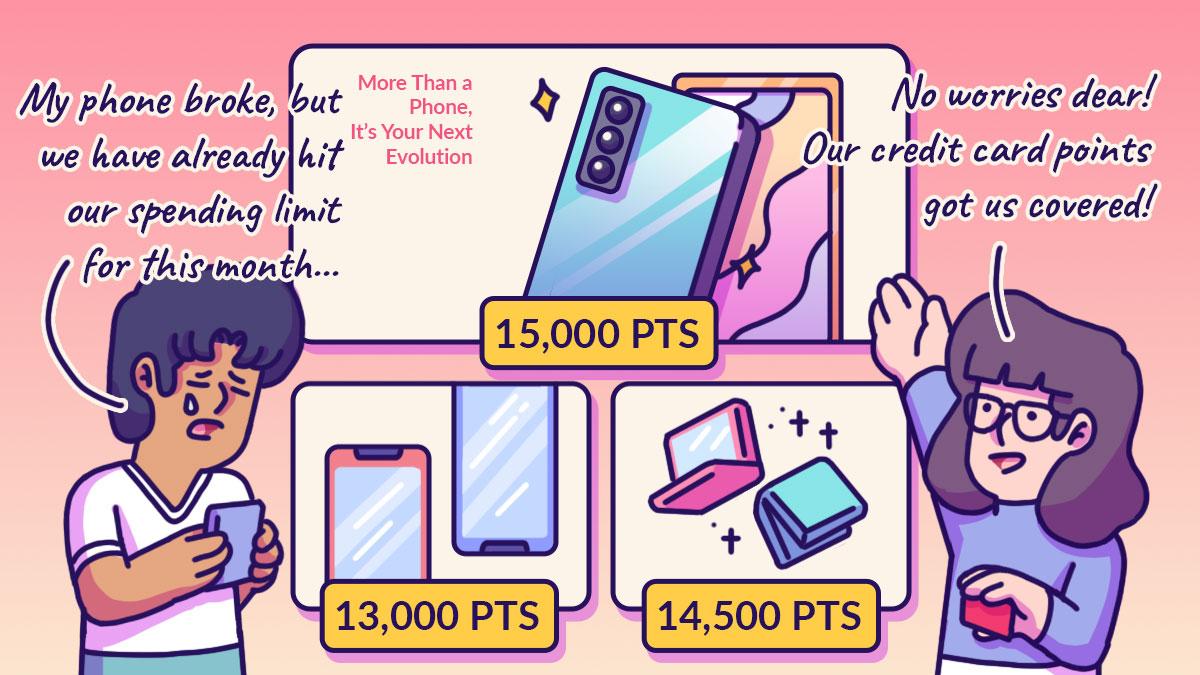

Credit card issuers like HSBC have a Rewards Marketplace where you can choose from thousands of items and gift vouchers from top brands like Apple, Dyson, Grab, and Shopee. You can browse the marketplace to see what items you can redeem for your points. The key is not just focusing on the raw value of the points but also on the joy of treating yourself to something special!Experiences with big cash price tags

Big-ticket items and luxury experiences often come with hefty price tags that can put a strain on your finances. But what if you could offset those costs with your credit card points? By using your points to pay for these high-value purchases, you can significantly reduce the financial burden, leaving more room in your budget and giving you the freedom to enjoy the things you love without the stress. These include:Big-ticket essentials

Sometimes, it’s the necessary purchases that can feel the most burdensome on your budget. Whether you need a new fridge, washing machine, or another household essential, using your points to cover these costs can ease financial stress.Brand name products

Whether you’re dreaming of the latest iPhone, a new TV, or a state-of-the-art laptop, your points can make these big-ticket items yours. It’s a smart way to splurge on high-end products without dipping into your savings.Premium travel

Points can turn a regular trip into a luxury experience. Imagine flying first class or staying in a five-star hotel without spending a dime. These premium experiences can cost thousands of dollars, but with points, they’re within reach.Maximising your rewards: Tips and tricks

To get the most out of your credit card points, a little strategy goes a long way. Here’s how to make your points work harder for you:Choose the right card(s) for your spending habits

Analyse where you spend the most money—be it on dining, groceries, or travel. Then, pick a card that offers the highest rewards in those categories. Alternatively, use a card selector tool to find the best match for your lifestyle.Take advantage of sign-up bonuses

New credit card applications often come with enticing sign-up bonuses to sweeten the deal. These bonuses can give your rewards balance a significant boost right off the bat. Just be sure you can meet the minimum spending requirement without overspending.Time your redemptions

If you have some flexibility, wait for promotions or sales before redeeming your points. Timing it right can help you get more value, especially when booking travel or buying products.