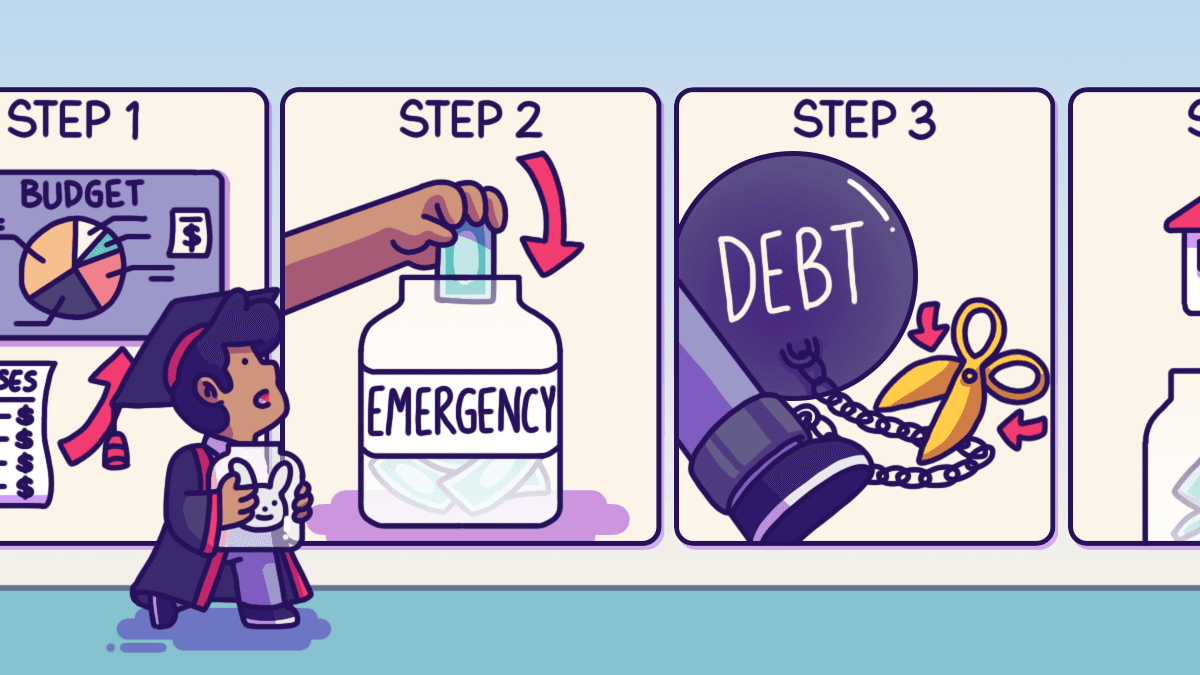

Track your expenses and learn to stick to a budget

When you first step into the working world, it’s tempting to believe you’ve got your spending habits under control from the get-go. How hard can it be to spend less than you earn, right? The truth is you’ll always struggle to save when you don’t truly understand where your money is going. And you won’t understand where your money is going until you make an effort to track it. The easiest thing you can do as a fresh graduate trying to build wealth is to start tracking your expenses. It doesn’t need to be overly complicated. Simply list down everything you’re spending your money on. You can do this on your Notes app, with an Excel sheet, or with the multitude of expense tracking apps available. Once you see where your money is flowing out into, it’s so much easier to start tweaking your spending habits and set up a budget. You might hate the word “budget” because you have this idea in your mind that you have to start depriving yourself of the things you love. But budgeting isn’t about that – it’s more of a tool to help you align your spending with your goals. Do you want to save up for your dream home or dream vacation while still allowing yourself to enjoy a guilt-free bubble tea every once in a while? A budget is your roadmap to get there.

Create an emergency fund

Life has a way of throwing unexpected curveballs our way – from medical emergencies to sudden job loss (yes, even it happens even to fresh graduates). In these instances, you don’t want to be caught off guard, scrambling to cover these expenses with high-interest loans or credit cards, or having to rely on your parents to pay for them. That’s why you need to start building your emergency fund as soon as you can. The recommended size of your emergency fund is six months of your living expenses. That can seem like a lot of money to work towards as a fresh graduate, but you can start by building at least a month’s worth of expenses first. Once you hit that goal, just keep building upon that as time goes on. The key to a solid emergency fund is liquidity, accessibility, and safety. You want this money to be easily reachable when you need it most, and you want it to earn some interest to keep up with inflation without risking your hard-earned cash. Look for high-yield savings accounts like the - Multiplier Account by DBS/POSB, which has been newly enhanced, where you can grow your money without jumping through complicated hoops, and still withdraw your money at any point of time without any penalties or fees. It may take time to build but having this financial cushion will prevent unexpected expenses from derailing your financial progress and give you peace of mind that future you will thank yourself for.Pay off your debt

Fresh out of school, some graduates are already carrying a significant financial burden – student loans. This might be your only debt but it’s still a financial obligation that needs your attention, nonetheless. Create a strategy for paying off your student loan efficiently. Commit to set aside a percentage of your pay cheque each month to pay off your student loan. By tackling your student loans proactively, you can free up your income for savings and investment a lot earlier, which will set you up for financial success as you progress through your career. Of course, you also have to ensure you’re not accumulating more debt while you pay off your student loans. Credit cards, for instance, are a common feature of adulthood and they can easily lead to debt if not managed responsibly. If you do use a credit card, it’s crucial to do so wisely. This means always paying off your balance in full every month. Not only does this prevent you from accumulating high-interest debt but it also helps you build a positive credit history, which will be essential for future financial milestones like buying a home. But if you struggle to control your spending and frequently carry a credit card balance, you might want to consider an alternative like a debit card instead. The broad message is this: strive to keep your debt load as low as possible. Some level of student loan debt may be inevitable but avoid accumulating more debt that could hinder your financial progress. The less you owe, the more financial freedom you’ll have.Invest in your long-term goals

Once you’ve got your budget in place, an emergency fund set up, and your debt under control, it’s time to think about your long-term financial goals. As a fresh graduate, you may not have ever thought about your long-term goals, nor are you ready to start thinking about them. Even so, leaving your money idling in a low-interest savings account won’t help you outpace inflation. Consider investing as a way to make your money work for you. Start small, and don’t be discouraged if you feel like you don’t know enough. There are plenty of resources out there today to read up on to help you get started. You can also consider beginner friendly investment vehicles like robo-advisors to dip your toes into the world of investing. As a bonus, some bank accounts like the Multiplier Account by DBS/POSB, will give you higher interest on your account balance if you invest using one of DBS’s investment vehicles. When it comes to investing, the key is consistency. Invest steadily, with a thought-out plan. Over time, your money will compound, and you’ll be amazed at how much it can grow.Taking it a step at a time

As a fresh graduate, the path to building wealth may seem long and challenging. But your advantage is that you have time on your side and with every step you take today, you are setting yourself up for a brighter financial future. You may not become a millionaire overnight but making consistent effort will pay off in the long run. So, stay disciplined, stay patient, and keep your financial goals in sight. You’ll find that financial stability is not an impossibility but a destination you can reach one step at a time. Content sponsored by DBS/POSB The enhanced Multiplier Account by DBS/POSB helps fresh graduates like you to get a head start in growing your money, even before you start on your first job. Track your expenses automatically without having to use excel sheet or expense tracking apps on digibank bank & earn summary when you use PayLah! and DBS/POSB credit cards on. If you’re below the age of 29 and don’t meet the income criteria, spending with PayLah! or any DBS/POSB credit card will qualify you for 1.5% per annum on your first $50,000 with no minimum spend required. Once you’ve secured a job or perhaps decide to become a freelancer or a gig worker, here’s the good news:- Salary credit criteria has been expanded beyond GIRO to include FAST and PayNow

- No minimum income is required to hit the Income goal

- Interest rates are now increased

- Minimum total eligible transactions has been lowered from $2,000 to $500