Article

What Are The Future Jobs In Singapore? Here Are 10 Recommendations

Perhaps you are already clear on your career path. Or perhaps you are looking at the headlines about: the rise of AI; volatile markets and international unrest; the effect of climate change and ESG; and you are wondering how to navigate a landscape that is moving beneath your feet. If you have to make decisions about your education or career, you may be wondering which career paths will offer stability and growth in the future. Should you consider a job switch or plan to go back to school to upskill yourself? The world of work is changing, and for those looking for professional inspiration, several fields are set to boom in the next decade, providing exciting opportunities for those equipped with relevant interests and skills. Here’s a rundown of 10 future-proof jobs in Singapore, the potential salary range, the skills you’ll need, and the education required to get you there. 1) Data Analysts Data is the new oil, and companies are increasingly relying on data to make strategic decisions. The field of data analytics grew by 34% between 2013 and 2018 in Singapore and is projected to grow by 27.6% globally in the next decade, making it a lucrative and stable career choice. Skills Required Statistical Analysis: Understanding and interpreting complex data sets. Programming: Proficiency in languages like Python and R. Data Visualisation: Using tools like Tableau or Power BI to present data insights. Critical Thinking: Ability to analyse trends and make data-driven recommendations. Recommended Education Tertiary education in Computer Science Tertiary education in Statistics Expected Monthly Salary Range: $4,000 to $15,000 2) Cybersecurity Professionals With the rise of the digital transformation, cyber threats are becoming more sophisticated. Cybersecurity professionals are essential to protect organisations from cyber-attacks and ensure data integrity and privacy. Skills Required Ethical Hacking: Identifying and fixing vulnerabilities. Knowledge of Security Tools: Familiarity with firewalls, intrusion detection systems, and encryption software. Risk Management: Assessing and mitigating potential security threats. Continuous Learning: Staying updated with the latest cybersecurity trends and threats. Recommended Education Tertiary education in Cybersecurity Tertiary education in Information Technology Professional Cybersecurity Certifications Expected Monthly Salary Range: $3,000 to $13,000 3) Software Developers From apps to enterprise software, developers are the backbone of the tech industry. With technology becoming increasingly integral to everyday life, the demand for skilled software developers continues to grow. Skills Required Programming: Proficiency in languages such as Java, C++, and Python. Software Development Lifecycle: Understanding Agile and DevOps methodologies. Problem-Solving: Ability to debug and improve software applications. Teamwork: Collaborating with other developers and stakeholders. Recommended Education Tertiary education in Computer Science Tertiary education in Software Engineering Expected Monthly Salary Range: $4,000 to $15,000 4) Mental Health Professionals The growing awareness and destigmatisation of mental health issues mean a higher demand for mental health professionals. This field is essential and cannot be automated, ensuring job stability. Skills Required Empathy: Understanding and supporting clients’ emotional needs. Communication: Effective listening and interpersonal skills. Problem-Solving: Developing treatment plans and strategies. Crisis Intervention: Handling emergency situations with care. Recommended Education Tertiary education in Clinical Psychology Tertiary education in Social Work Tertiary education in Psychology Expected Monthly Salary Range: $2,500 to $8,000 5) Artificial Intelligence (AI) Specialists AI is transforming industries, currently automating tasks and providing insights, but given its constant evolution the scope for growth in this sector is boundless. AI specialists are at the forefront of this revolution, creating and managing AI systems. Skills Required Machine Learning: Designing algorithms that allow computers to learn from data. Programming: Proficiency in languages like Python, Java, and R. Data Analysis: Analysing large data sets to train AI models. Problem-Solving: Tackling complex challenges in AI applications. Recommended Degrees Tertiary education in Computer Science Tertiary education in Artificial Intelligence Expected Monthly Salary Range: $4,500 to $15,000 6) Environmental, Health, and Safety (EHS) Managers As companies become more aware of their environmental impact and workplace safety, EHS managers are crucial in developing and implementing policies to ensure compliance and safety. Skills Required Incident Investigation: Analysing workplace incidents to prevent future occurrences. Safety Management Systems: Implementing and monitoring safety protocols. Environmental Protection: Ensuring compliance with environmental regulations. Communication: Effectively conveying safety procedures to employees. Recommended Education Tertiary education in Environmental Science Tertiary education in Occupational Health and Safety Expected Monthly Salary Range: $3,000 to $10,000 7) Data Engineers Data engineers ensure the smooth flow of data across an organisation. As data continues to drive business decisions, the demand for data engineers to build and maintain data infrastructure is set to grow significantly. Skills Required SQL: Mastery of Structured Query Language for managing databases. Programming: Proficiency in Python, Java, or Scala. Data Warehousing: Knowledge of building and managing data warehouses. Cloud Computing: Experience with platforms like AWS, Google Cloud, or Azure. Data Visualisation: Ability to present data insights effectively. Recommended Education Tertiary education in Computer Science Tertiary education in Statistics Expected Monthly Salary Range: $3,000 to $16,000 8) Human Resource Professionals Human resource professionals play a crucial role in aligning HR strategies with business objectives. With organisations increasingly recognising the importance of strategic HR management, human resource professionals are becoming indispensable. Skills Required Strategic Planning: Aligning HR practices with business goals. Communication: Strong interpersonal skills to manage relationships. Change Management: Leading and managing organisational changes. Employment Law: Understanding legal aspects of HR. Problem-Solving: Addressing and resolving employee-related issues. Recommended Education Tertiary education in Business Management Tertiary education in Human Resource Management Expected Monthly Salary Range: $3,000 to $10,000 9) Renewable Energy Engineers As the world shifts towards sustainable energy, renewable energy engineers are at the forefront of designing and implementing green energy solutions. This field is essential for addressing climate change and ensuring energy security. Skills Required Project Management: Leading renewable energy projects from inception to completion. Technical Skills: Knowledge of solar, wind, and other renewable energy technologies. Analytical Skills: Assessing energy needs and optimising systems. Sustainability: Understanding environmental impact and sustainability practices. Regulatory Knowledge: Compliance with energy regulations and standards. Recommended Education: Tertiary education in Environmental Engineering Tertiary education in Mechanical Engineering Tertiary education in Renewable Energy Expected Monthly Salary Range: $3,000 to $8,000 10) Digital Marketing Specialists With the ever-expanding digital landscape in a constant state of flux, businesses need digital marketing specialists to navigate online platforms, engage audiences, and drive growth. This role is crucial for maintaining a strong online presence. Skills Required SEO & SEM: Optimising content for search engines and managing paid search campaigns. Content Marketing: Creating and distributing valuable content to attract customers. Social Media: Leveraging social media platforms to build brand awareness. Data Analytics: Analysing metrics to improve marketing strategies. Creativity: Developing innovative marketing campaigns. Recommended Education Tertiary education in Marketing Tertiary education in Communications Certifications: Google Analytics, Facebook Blueprint, HubSpot Inbound Marketing Expected Monthly Salary Range: $2,500 to $8,000 What if I am not sure what to apply for? If you haven’t already noticed, some qualifications open the doors to several positions, meaning you can keep your options open. For example, with a Bachelor’s Degree in Computer Science, you can apply to be a Data Analyst, Software Developer, AI Specialist, or Data Engineer. Then there are other more niche fields, which require specific education – Mental Health Professionals will need to be qualified in either social work, clinical psychology, or psychology and put in clinical hours to gain more experience. In addition some roles exist across multiple sectors, allowing you to engage or specialise in work that aligns with your interests. Some jobs are open to applicants who have transferrable skills or who have taken certifications instead – Digital Marketing Specialists with certifications in Google Analytics. In an ever-changing job market, choosing a future-proof career is about finding a balance between your interests and the market’s needs. The 10 careers mentioned here promise both growth and stability but also offer exciting opportunities to make a significant impact. There are also a multitude of resources to help you plan your career including government bodies like Workforce Singapore and Myskillsfuture, and universities. It also helps to attend an education or career fair to get some idea of what the future of jobs holds for us. So, as you plan your career journey, look to the future, do the research and consider the options and education that will lead you to success! This content is part of the Temasek – Financial Times Challenge, a financial literacy education series in Singapore for youths.

5 Travel Budgeting Tips For A Wallet-Friendly Adventure

5 Places to Park Your Money In 2025

I Thought My Mum's Insurance Could Cover Her $80,000 Operation. I Was Wrong.

How To Tidy Your House for New Year Using the KonMari Method

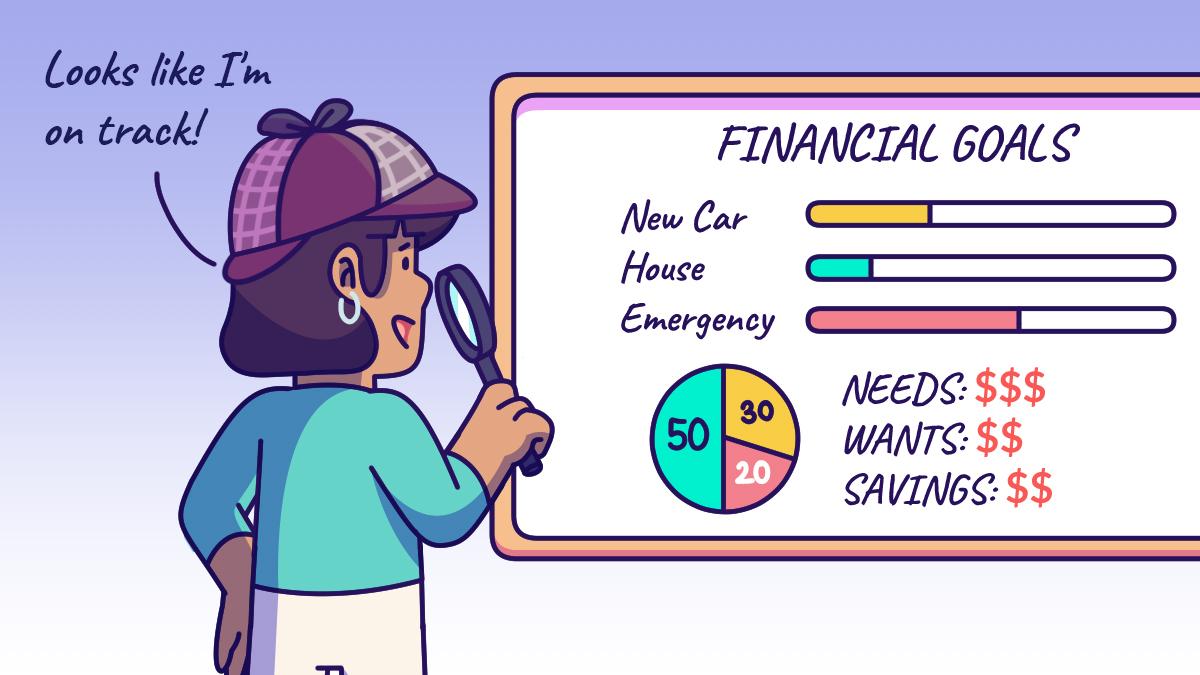

Want To Set Your Financial Goals? Here Are Six Pro Tips

I Couldn’t Escape The Monday Blues Until I Discovered Bare Minimum Mondays

5 Tips To Refresh Your Home In The New Year

I Never Thought My New Year's Party Gift Would End Up Like This

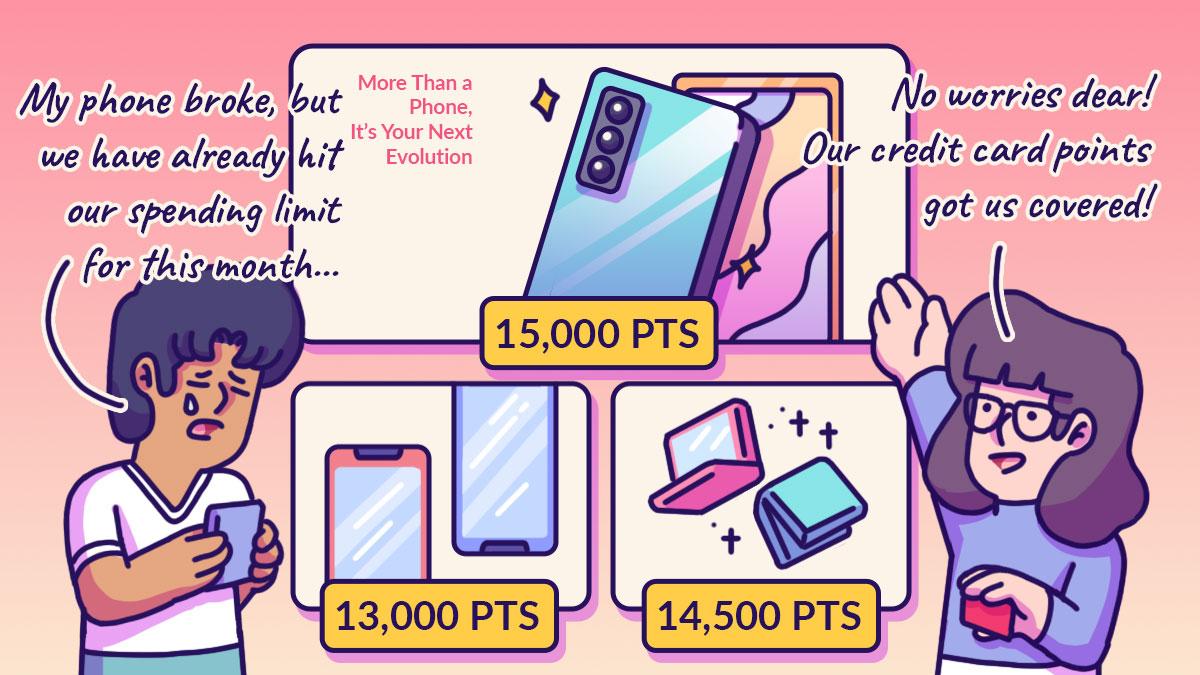

Am I Leveraging My Credit Card Points?