Personal Finance

How I’m Protecting My Money In Uncertain Times

Every time I scroll through social media, it’s full of protests, wars, and prices that just keep rising. Sometimes I wonder, what’s the point of saving if my money feels like it’s shrinking by the day? Although the unrest happens far away, I can still feel the impact back home. The coffee I usually buy costs more, transport fares are higher, and my monthly grocery bill is shocking. I do have savings, but their value keeps thinning out. Eventually, I realised I can’t control protests on the streets or wars overseas that shake currencies, or the geopolitical conflicts that affect markets and economies. The only thing I can control is how I manage my money. So, I’ve started to adjust my savings and investment strategy, slowly but surely. I am starting to set aside an emergency fund, so I won’t panic when unexpected expenses pop up. This will also help me if I ever have to go through any job changes in such uncertain times. I’m also trying to diversify by not putting everything in one account or financial instrument. That way, if one falls, I’ve still got something to fall back on. I try to avoid fear of missing out (FOMO) when it comes to investing, especially when the markets feel unpredictable. Recently, a friend suggested I keep part of my savings in currencies, like USD or SGD. They said it could help protect the value of our money. And lastly, I keep up with the news, but only enough so I don’t spiral into more anxiety. I’m still scared, especially every time I see prices climb again. But with these small steps, at least I can tell myself: I’m doing my best to protect my money. And for now, that’s all I can do. This article is part of TSS Confessions, a weekly column where we delve into personal finance topics that are unscripted and genuine real accounts from people.

POV: I Finally Opened My First Trading Account, And I’m Preventing My Trades From Going Wrong

Is This Bare Minimum Or Princess Treatment?

Is Micro Retirement A Smart Move? Or Are You Just Burning Through Your Retirement Funds?

Shopper’s Quest: Surviving The Final Boss Called Checkout

Interest Rates Are Dropping. Here’s Where To Park Your Cash Instead

Help! I Paid For My Wedding Via ‘Buy Now, Pay Later’ And I’m No Longer In Bliss

Join Hearts, But Keep Joint Accounts Only If Necessary

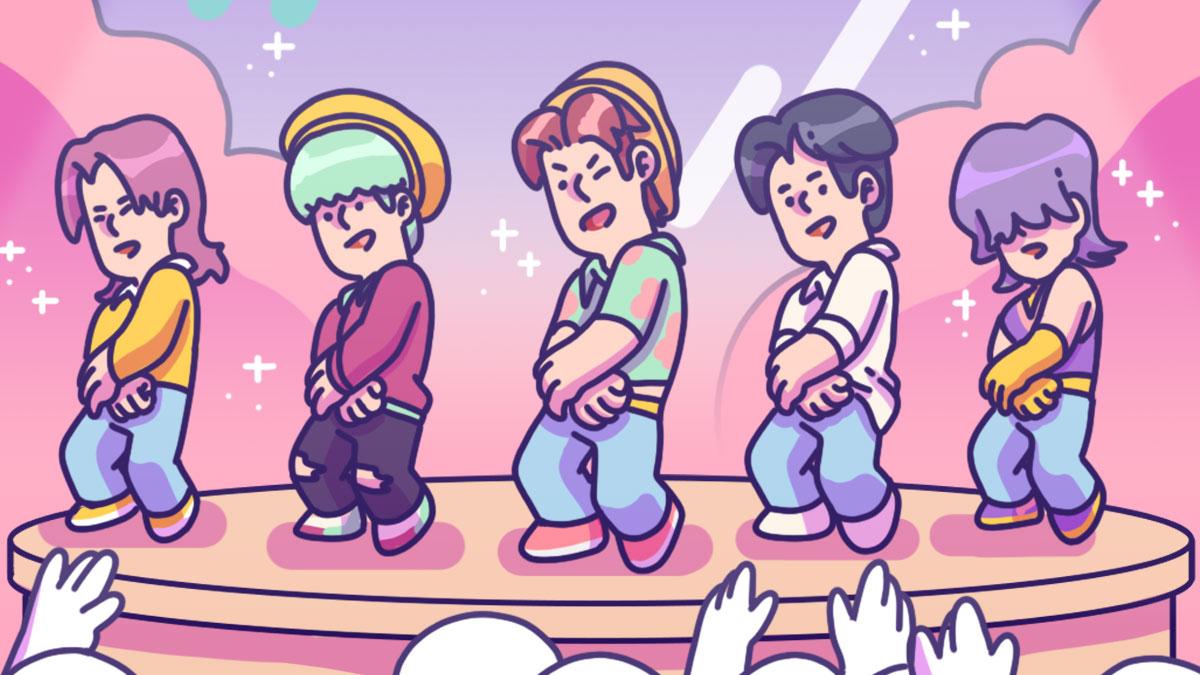

#FandomBroke: When Passion Meet-And-Greets Price Tags

Doom Spending Is Real, And You Might Not Even Know You’re Doing It