Personal Finance

#49: How to Save Money via Impulse Journalling

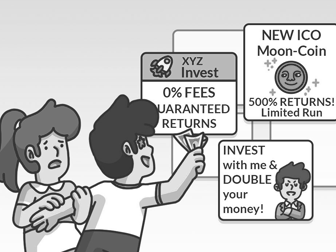

Wait, when did I pay for this?! That gym membership you got out of impulse, taking a cab home even when you don’t really have to. These are all the hidden culprits of our depleting bank account. Impulse buying is normal for everyone but when it gets out of hand, how can we avoid making purchases out of impulse? In this episode, our hosts talk about what they can do to stop impulse buying, the difference between compulsive and impulsive spending, how impulse buying is linked to your emotions and gamifying your process of delayed gratification. We’re on Spotify, Apple Podcast and Google Podcast! Subscribe to us for new weekly episodes weekly.

25 Mar 2021

READ MORE0

How To Control Your Spending

19 Mar 2021

0

Fuss-Free Finances (For Those Who Have Too Much on Their Plate)

11 Mar 2021

0

Should You Refinance Your Home Loan?

03 Mar 2021

0

S4E2: Coffee Break: Should I Opt Out of Gambling This CNY?

06 Feb 2021

0

Cost-per-Use: How to Maximise Sale Season and Get More Value From the Money You Spend

02 Feb 2021

0

Love Overseas Spending? Here’s How to Work Around Foreign Exchange Fees

02 Feb 2021

0

The Pros and Cons of Double Sales

28 Jan 2021

0

What You Need to Know About The Covid-19 Recovery Grant

15 Jan 2021

0

S3E21: Coffee Break: What Are Your (Financial) New Year Resolutions?

01 Jan 2021

0

SUBSCRIBE

STAY UPDATED!

And join our community© Copyright 2025 The Simple Sum. All Rights Reserved.