Personal Finance

Debunking the ‘Buy More Insurance While You’re Young’ Misconception

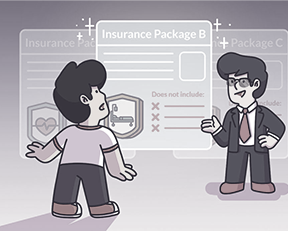

This content is brought to you by the Ministry of Health, Singapore.“Buy more now while you are still young and healthy.” “Don’t wait for something to happen before you get insurance.”I’m sure many of us grew up hearing these lines from our parents and peers. From a young age, we’ve been told to get comprehensive health insurance early to avoid paying more for treatments later on.We’ve also been told that since premiums are affordable when we are young, we should secure the most comprehensive coverage early to avoid potential exclusions that might arise from health conditions later in life. While it’s true that premiums are lower when we’re young, this shouldn’t be a reason to over-insure ourselves. It’s important to understand that insurance premiums will increase with age, regardless of when we start our coverage. Health insurance is not a savings plan; you have to pay for it as you go along. It’s not something that you can accumulate to a sum to withdraw later.Additionally, by purchasing health insurance without understanding your needs, you could be spending more than necessary on premiums for protection that you might not even need.Here’s why.You’re already covered by MediShield Life.In Singapore, every citizen and permanent resident is automatically covered by MediShield Life, the national basic health insurance plan. It is meant to protect you against large hospital bills and selected outpatient treatments for life, and is sufficient to cover subsidised care in public hospitals such as in Class B2 or C wards. The annual premiums and deductibles can also be covered by funds from our MediSave accounts. (You can view the full list of MediShield Life coverage and benefits here.) Those who opt to stay in Class A or B1 wards or seek treatment in private hospitals can still receive coverage, but only a smaller portion of their medical bills will be covered.This has prompted many Singaporeans to pursue Integrated Shield Plans (IPs) to provide coverage for unsubsidised care and add-on riders to further reduce their out-of-pocket costs when they need to seek treatment.So, what are IPs and riders?Data shows that 7 in 10 Singapore residents own an IP, while 2 in 3 IP policyholders also add on a rider. So, what are they, and what do they cover?IPs are optional health insurance plans provided by private insurance companies that offer additional coverage on top of MediShield Life. The additional coverage includes unsubsidised bills in public healthcare institutions (i.e. Class A or B1 wards) or bills in private hospitals, depending on the plan. For IP policyholders who file claims, they still have to pay out of pocket:a) An annual deductible, which is generally a few thousand dollarsb) Co-insurance, which is 10% of the remaining bill after the deductibleTo further reduce out-of-pocket payments after IP coverage, some choose to purchase riders. However, even with a rider, policyholders will still need to co-pay a minimum of 5% of the claimable amount. The premiums for riders can only be paid in cash and are much higher for older age groups. These premiums could increase by up to three times between the ages of 50 and 70. For example, someone in his 70s could be paying $9,000 a year for private hospital riders.Despite this, most of the time, the rider has a significantly smaller payout compared to IPs for large bills. Even for large private hospital bills, most of the bill is paid by the IP rather than the rider. For instance, for a $45,000 knee replacement surgery private hospital bill, the rider only pays out $5,000 while the IP pays out $36,000. The additional coverage from the rider may not be much, but the cumulative amount paid in extra premiums over the years could be quite a lot. Are you overspending on your coverage?1. Check your coverageTake a closer look at your health insurance coverage and ask yourself if it fits your needs. Consider factors like your age, lifestyle, and family health history. You should also evaluate the types of hospitalisations (public and private), and the ward classes it covers and see if it matches your healthcare preferences. 2. Evaluate the costs over timePremium increases over time and as you age, so it’s crucial to evaluate whether you’ll be able to afford these costs during retirement or periods of reduced income. While MediShield Life premiums are fully payable by MediSave, IP premiums can only be paid by MediSave up to withdrawal limits, and riders must be fully paid in cash.Although they provide maximum coverage, the additional premiums of higher-tier riders may result in a greater financial burden later. Therefore, you can consider whether the additional coverage from higher-tier riders is worth the price of premiums over the years.3. Get help to right-size your insurance coverageSometimes, overspending can slip under the radar, so it may be wise to seek a second opinion on your insurance plans. There are several ways to right-size your coverage to keep it cost-effective while still getting the protection you need. You can consider if you are willing to downgrade your ward class for your IP and rider. For example, someone in their 50s on a private hospital IP and rider may spend up to $300,000 in premiums over the next 30 years. If they choose to downgrade to a Class A IP and rider, the premiums could be reduced to around $80,000. After all, about half of those who own IP and riders end up using subsidised healthcare when they were hospitalised. Another option is to downgrade to a lower-tier rider, which is cheaper and still provides adequate protection against large medical bills. For example, riders that have slightly higher co-payment but still provide a cap for your out-of-pocket expenses. The savings you gain from these right-sizing options can be redirected into other needs—such as your retirement plans or investments. But don’t be hasty—it is important to make your decision considering all factors, including both changes in coverage and the savings in premiums. You can consult a trusted financial advisor to provide insights on whether you really need additional coverage based on your healthcare needs and preferences. They can also help review if your insurance premiums are taking up too much of your income, especially as you age. Sponsored content by the Ministry of Health, Singapore.Not sure if your health insurance is giving you enough coverage? Or if you might be overpaying? You’re not alone. Many policyholders find it challenging to keep track of how much their MediShield Life, Integrated Shield Plans, and riders actually cost. Speak to a financial advisor to review your coverage and right-size your plans to fit your needs!* All figures cited are as of October 2025 and may vary across plans.

I'm Preparing For Retrenchment, Even Though I'm Not In Danger — Yet

How 10.10 Shopping Is Done, Done, Done

Chasing The 5Cs Left Me Tired And Miserable

Go Big Or Keep It Small?

5 Questions To Ask Yourself Before Taking A Personal Loan

I Bought My First Luxury Watch Thinking I Could Afford It, Only To End Up With Very Tight Cashflow

Is Pickleball All Style, No Serve?

New To Investing? Here Are Some Power Moves

Tie The Knot Like A Star, Without The ‘Celebrity’ Price Tag