Investing

5 Places to Park Your Money In 2025

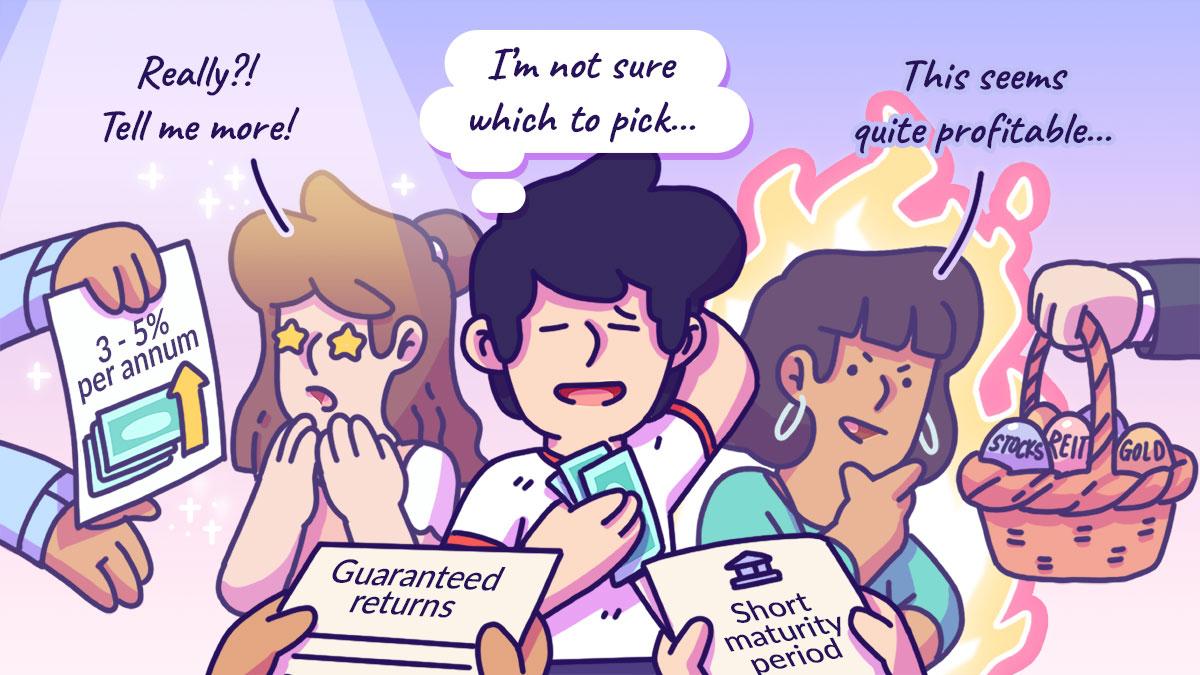

Ring in the new year! Start anew with your financial health by planning on what to do with your hard-earned money. In the past, your elders may have advised you to park your money in your bank accounts (or under your pillow) and to not risk losing your money to any unorthodox schemes. However, we have come a long way since then, and as we are more educated on the ways to manage our personal finances, we learn that there are other strategies to raise your money passively. From high-yield savings accounts to bonds, we have broken down the volatility and suitability of each money vehicle for you to start planning your financial moves with the opportunities available this year. 1. High-yielding savings accounts (HYSA) Compared to basic savings accounts that typically yield an interest rate of 0.25% to 1.5% per annum, high-yielding savings accounts (HYSA) offer a higher interest rate of between 3% and 5% annually. You can earn more returns with the money you park in your account, which is ideal for growing your emergency funds or saving up for your dream trip. These savings accounts are relatively low-risk as most of them are offered by financial institutions and insured by government-backed entities. Interest rates in savings accounts are also fixed, providing stable returns without affecting your principal amount. However, it’s important to know that the interest rates may still vary, depending on the economic conditions and the bank’s strategic decisions. For instance, UOB announced its rate cuts on its flagship savings accounts from 3.85 - 7.8 per cent, to 3 - 4.5 per cent a year in 2024. This was to align with the market expectations of rate cuts by the US Federal Reserve. For some HYSAs, some bank accounts may impose limits on transfers and withdrawals, so do review the terms & conditions carefully before opening a high-yield account. 2. Fixed deposits Fixed deposits (FDs) are still widely considered as one of the safest options for park your excess money. Your principal amount and returns are guaranteed, and you can also choose the length of your tenure. FDs offer predictable returns based on the fixed rate, so you will know exactly how much you will be earning. Furthermore, it encourages saving discipline because you will be less motivated to withdraw your money and spend it due to withdrawal charges. The returns for FDs are, however, mostly lower than other investment options such as mutual funds and stocks, so you may miss out on better ways to grow your money. It limits liquidity too, because any early withdrawal will incur penalties or loss of interest. Therefore, it is bestto only set aside some of your savings in FD, so you can have accessible funds for unexpected scenarios. 3. Bonds and treasury bills For those looking for safe and secure investments, saving bonds and treasury bills are the way to go. Government savings bonds, such as Singapore Savings Bonds (SSB) are fully backed and guaranteed by the Singapore government, so you will not face the possibility of losing your principal. It is perfect for long-term investment due to its step-up interest rate, where the longer your money is kept there, the higher the interest rate accrued. Not to mention, it is flexible so you can choose to exit anytime without incurring hefty fees! As for government treasury bills, they have shorter maturity periods compared to SSBs, ranging from 6 months to 1 year. These bills are issued through auctions, where investors can buy them at a discount and earn returns when they mature at their face value. Although they are one of the safest investment options in Singapore, SSBs and treasury bills are offering lower yields in the latest tranche due to market conditions. According to recent reports, SSB opening yields have fallen to a 10-year average return of 2.77 per cent in October 2024, down from 3.1% in September 2024. For 2025 you may want to research the yields before committing, as you may miss out on other investment options with higher yields. 4. Unit Trust Funds Unit trust funds (also known as mutual funds) are investment vehicles that pool money to invest in a diversified portfolio of assets, including stocks, bonds, and other money market instruments. Stashing your money here requires minimal attention as they are professionally managed by fund managers. Investing in mutual funds is efficient as a medium- to long-term investment. So, if you are not planning to use your savings for the near future, parking your money in these funds can potentially provide you better returns than cash savings and fixed deposits. Yet, it is important to note that some of these funds do not guarantee your principal investment, meaning you may lose part of your money depending on the performance of the fund, therefore the risks are higher. If you prefer to park your money in a fund that has minimal risk, look for the ones that are low in Fund Volatility Factor (FVF), which measures the fund's returns over a period of time. 5. Retirement funds There are many retirement funds that allow you to contribute voluntarily, so you can build your way towards financial security in your later years. For Singaporeans, we are provided with a Central Provident Fund (CPF) account which is funded by mandatory contributions from our employers and employees (us!). The CPF offers a relatively higher interest rate (of 4%), allowing you to earn compounding interest until you retire. To grow your savings, you can actually make voluntary contributions to your CPF retirement fund (but not exceeding the CPF Annual Limit of $37,740). Voluntary contributions to these funds also offer tax advantages, including a tax relief of up to $8,000, if you make a top up to yourself. Although you can only access the funds when you retire, the money is vital for you in your golden years when you are no longer generating income, making it a worthwhile investment.

Digibanks, Robo-Advisors, Cryptocurrencies, Crowdfunding: 4 Investment Tools For Young Adults

Optimise Your Finances With A Multicurrency Account

Are All Finance Influencers Reliable?

Debunking financial "Fairy Godmothers"

A Chicken And Egg Situation

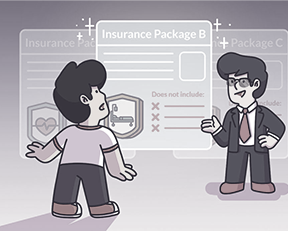

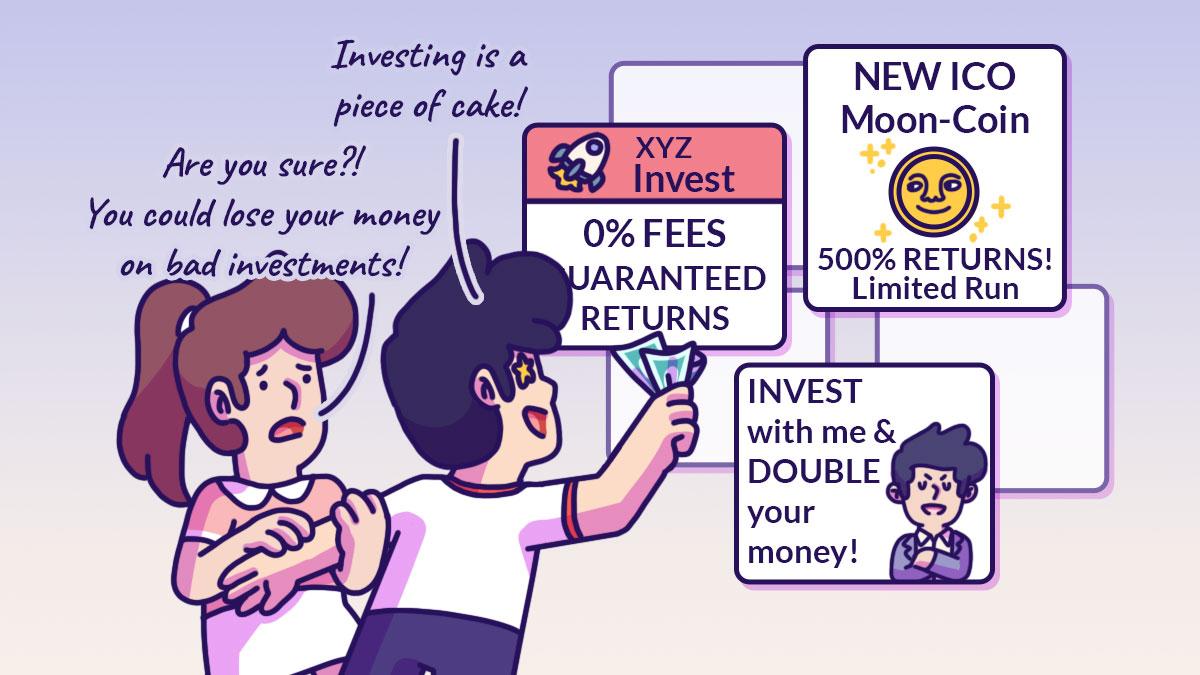

Is This A Safe Investment? Here’s What To Watch Out For When Investing In Products

The Chemistry Of Investing: Balancing Capital, Knowledge And Risk

How To Start Investing In The Stock Market In Singapore

Understanding Investment-Linked Insurance Plans