Financial Planning

Podcast Roundup: The Singaporean Dream of Living Alone (Episode 1)

Welcome to the start of your podcast journey with the TSS team! Get ready for eight full episodes of talking about everything personal finance, from investing to learning how to be better at budgeting.In our inaugural episode of Keep It Simple, our hosts get up close and personal with a story about moving out and living alone. For those of you who’ve always wanted to live alone and go for that independent life, this episode is for you.Here’s a quick roundup of what went down: Criteria for Picking a Place (5:43) An accessible place Commute to work to be less than 1 hour Sometimes your flat comes with furniture pre-bought; some places don’t allow you to redecorate them Your rent should not be more than 30% of your pay (7:31) or a third of your salary so you still have disposable income to save Benefits of Living Alone (15:18) There’s a lot of freedom involved, even if lonely – this is not necessarily a bad thing Most Singaporeans may feel claustrophobic from living with parents for too long Freedom Comes With a Price: Rent (20:40) Rent will never go away and will become a permanent fixture in your expenses Sometimes, staying at home means you’ll have to give parental allowance as well Problems that arise with landlords or roommates can’t be easily resolved or blown over vs. dealing with it with your parents Have a buffer amount of savings before you commit to moving out (separate from emergency funds) Listen to the full episode here.

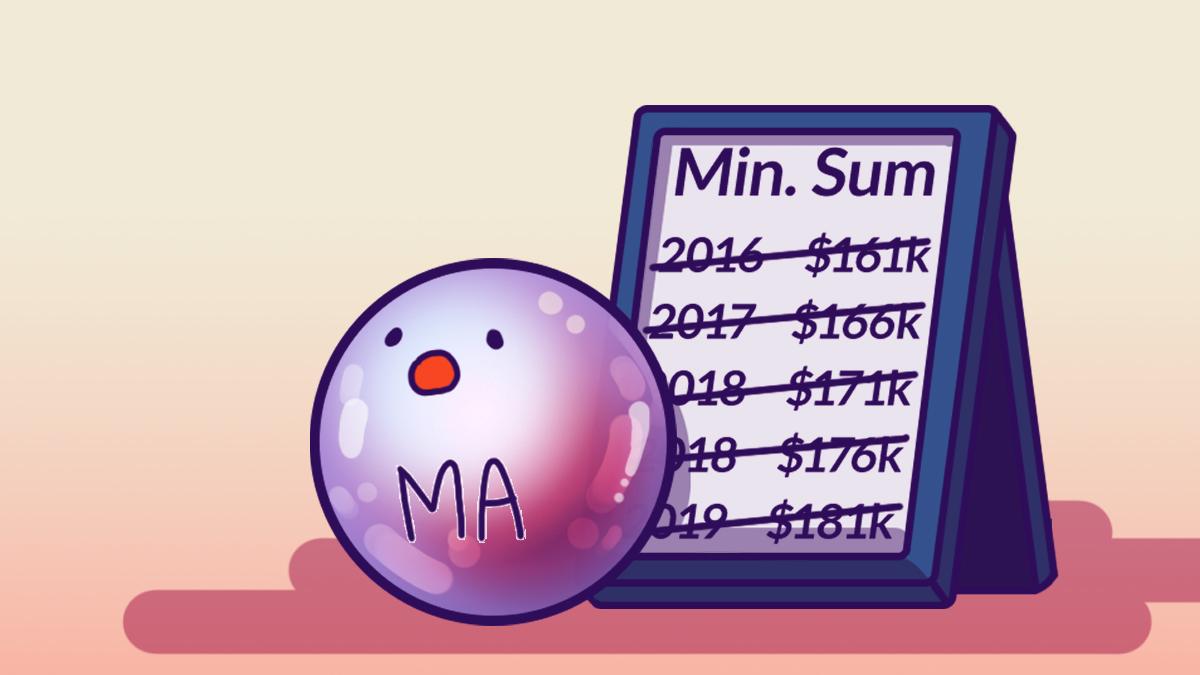

Earn More Interest by Delaying CPF Transfers

Renovation Loan Vs. Personal Loan

Your Home Loan Is Tied to the US Economy

S1E3: Setting Financial Milestones

S1E2: How to Save for an Emergency Fund

S1E1: The Singaporean Dream of Living Alone

The $16k Mistake Singaporeans Make at Age 55

Why it's Hard to Save for Retirement

The Basic Healthcare Sum