Confessions

Increased Cost Of Living Is Causing Me To Have More And More Credit Card Debt

When we think of cost of living, we think about the cost of food, clothing, transport fees, rental or mortgages and also our salaries. I noticed many videos recently interviewing the man on the street on cost of living, asking them what’s their ideal salaries.I think money is never enough. It is true that if I have more money, I will be more comfortable, but will that really be enough? When I started earning more as I worked longer in my career, I fell under the lifestyle trap. Then it led to me spending more to enjoy the luxuries of life.Now that everyone is grappling with inflation, our wallets are squeezed, and I feel like I don’t have enough money to sustain the lifestyle I have. So, I turn to borrowing money from banks via credit cards.It was not helpful that I was incentivised to sign up for credit cards in this period as well. Slowly, with the buy now pay later and 0% instalment benefits, it made me think that I could purchase a new fan to replace the one that broke down and many other purchases that felt urgent at that point.Only recently then I realise that I was unknowingly taking a larger sum from my monthly salary to repay my credit card bills (even with 0% instalment repayment). This caused me to feel the budget cut on my daily expenses and I had to cut down on food to not fall deep into debt.I have since tried to wait it out whenever there is a need to purchase a new item or from going shopping. Although I know that this cost of living problem should be temporary, there is no way I want to end the year with a huge debt knocking on my door.This article is part of TSS Confessions, a weekly column where we delve into personal finance topics that are unscripted and genuine real accounts from people.

A Career Change For The Better: My Personal Story

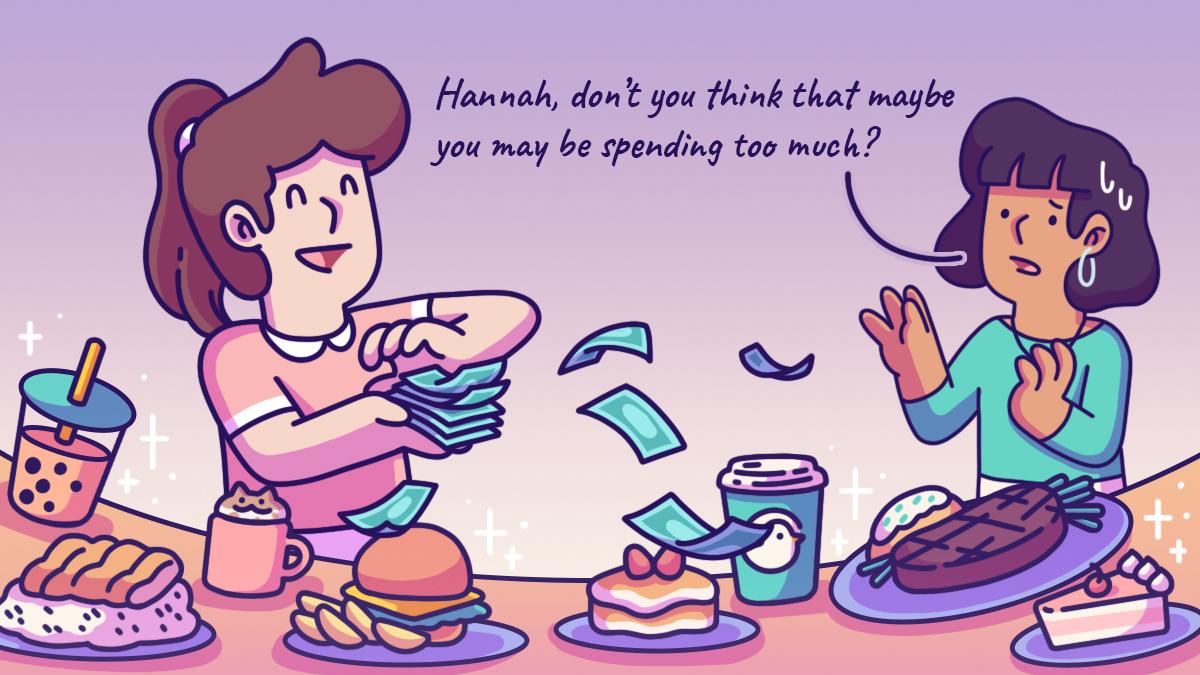

I Love To Spend My Salary On Delicious Food, Cafe Hop, And At Popular Restaurants

I Stopped Buying Branded Cosmetic Jewellery And Switched To Gold Ones Instead

How Avoiding Office Politics Helped Me Save Money And Protected My Mental Health

I Switched To Local Grocery Household Brands Because I Can’t Afford Premium Brands Due To Inflation

I Dread Going To Work, So I Take Taxi Or Ride-Hailing Almost Every Day

I Own Multiple Digital Bank Accounts And I Move Funds Whenever An Account Offers The Highest Interest Rates

I Found More Than 50 Bags In My Closet, Some I Forgot I Had Purchased Them

I Eat Instant Noodles Everyday But I Drive A Luxury Car