What do you do when you’re in a financial pinch and running low on funds? In school, we used to borrow lunch money from our friends to make it through recess. As an adult, while friends are still an option to borrow money from, you could also get a personal loan — it’s different from a housing or car loan.Provided by banks, a personal loan allows a person to borrow an amount of money based on their monthly income, their relationship with the bank, and their credit score. You could argue that credit cards allow you to do the same thing — to pay for things with money you don’t have right now — but personal loans boast lower interest rates, making repayments more affordable and debt management easier.But just because personal loans are highly accessible and easy to apply for, that doesn’t mean we should be drawing on them just because we would like to spend more money than we have. Instead, good financial management says that a personal loan should be taken for good reasons. So, what counts as a “good” enough reason?

What do you do when you’re in a financial pinch and running low on funds? In school, we used to borrow lunch money from our friends to make it through recess. As an adult, while friends are still an option to borrow money from, you could also get a personal loan — it’s different from a housing or car loan.Provided by banks, a personal loan allows a person to borrow an amount of money based on their monthly income, their relationship with the bank, and their credit score. You could argue that credit cards allow you to do the same thing — to pay for things with money you don’t have right now — but personal loans boast lower interest rates, making repayments more affordable and debt management easier.But just because personal loans are highly accessible and easy to apply for, that doesn’t mean we should be drawing on them just because we would like to spend more money than we have. Instead, good financial management says that a personal loan should be taken for good reasons. So, what counts as a “good” enough reason?Paying off existing credit card debt

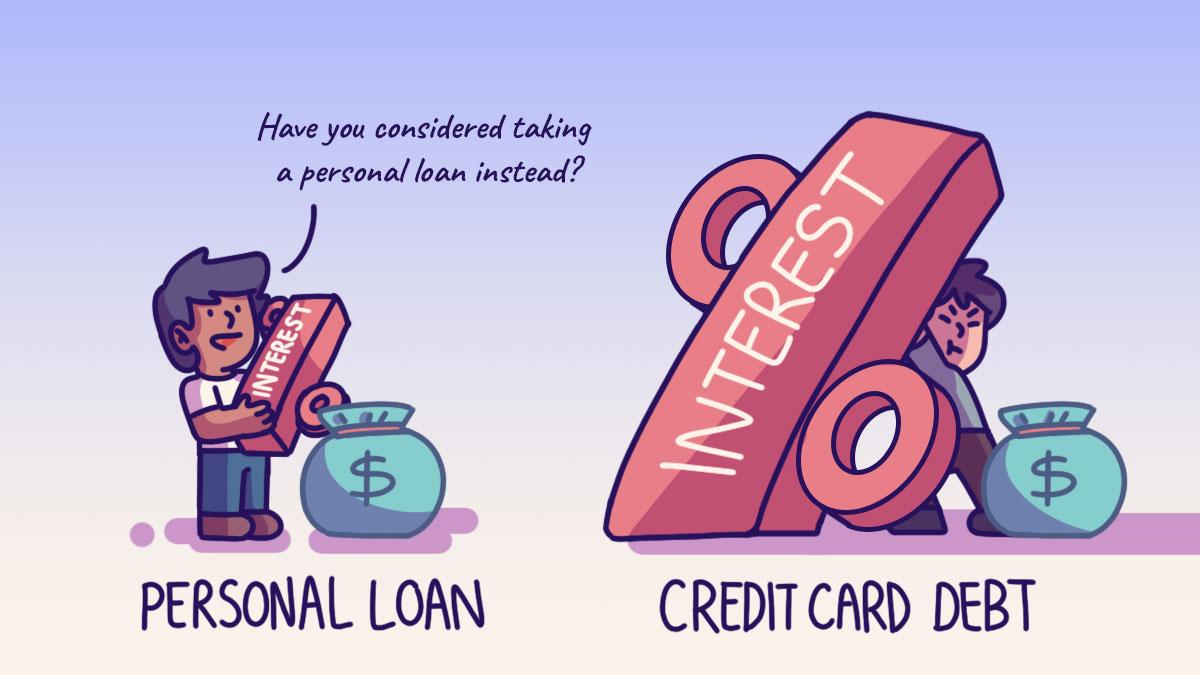

It’s not unrealistic for some of us to let our debt get out of hand, especially when we weren’t taught good financial habits before taking them on. Specifically, you may have accumulated credit card debt that you’re having trouble paying off right now. A personal loan could be your answer to clearing your credit card debt before it snowballs even more. Credit card debt can absolutely total your finances in the blink of an eye. On average, credit card interest rates can go up to 30% per annum, which means that even if you’re just meeting the minimum monthly repayment, the interest incurred on your balance could be more than the amount you’ve repaid.On the other hand, personal loans are much gentler on your wallet, with kinder interest rates ranging from 3% to 5% per annum. Unlike credit cards where you have to pay a percentage of your card balance as the minimum, the interest rate on a personal loan is fixed throughout the loan tenure. This means that you don’t need to pay more than the specified repayment amount each month, so you can plan your budget as your monthly debt obligation is more predictable. When applying for a personal loan, add up your credit card owing and choose a loan amount that can cover the full amount to pay it off. Just a note that when comparing between personal loans to choose a loan that gives you an attractive effective interest rate (EIR). The stated interest rate is just the nominal interest rate, which doesn’t account for the true cost of taking the loan. The effective interest rate (EIR) factors in administrative fees and charges as well. For example, if you’ve taken a personal loan of $25,000 with a 5% interest per annum but are being charged an additional 1% for processing fees, then the total interest you’re paying back is not just $1,250 but actually $1,500. In other words, while the nominal interest rate is 5%, the EIR is actually 6%! The repayment schedule – the number of instalments and the frequency of instalments – also affects the EIR. To decide on the right personal loan, you need to figure out what your needs and capabilities are. Picking a personal loan that demands you pay more every month and with a shorter tenure may not be the best option if you’re having cash flow issues.Paying for planned big-ticket purchases

With every life stage, there might come big ticket purchases you have to make. This includes paying for that wedding on the horizon, renovating and furnishing your long-awaited BTO, or even replacing your trusty laptop that’s finally given out after years of care and use.

If you weren’t able to build up the savings for it yet but for some reason you absolutely need to make that big purchase right now, you can consider taking a personal loan to pay for it (instead of using a credit card). As mentioned above, the lower interest rates make personal loans much easier to deal with and manage compared to credit cards. And it’s not just the lower interest rates that are an advantage—taking a personal loan can actually aid you in planning out your finances better because of something called a loan tenure.

In essence, a loan tenure refers to the time horizon you’re given to pay back your loan in full. Your loan tenure could be 12 months, 36 months, or even longer. Knowing how long your repayment period will be is going to be helpful as you plan out your monthly budget and finances and will help you complete your repayment with as little trouble as possible.

Note that there may be the option of changing your tenure if circumstances change and you suddenly can’t finish making repayments in the agreed amount of time. But extending your loan’s tenure will come at a price and not all banks offer such flexibility, so make sure that you are confident that your finances can handle the added debt obligation.

If you anticipate that you’ll have cash flow issues once you make the big purchase or if you’re unable to save up in time for any reason at all, a personal loan will allow you to redirect your efforts towards charting your expenses with more visibility once you’ve determined the monthly repayment amount. But of course if you can, it’s always best to pay upfront with your hard-earned savings.

With every life stage, there might come big ticket purchases you have to make. This includes paying for that wedding on the horizon, renovating and furnishing your long-awaited BTO, or even replacing your trusty laptop that’s finally given out after years of care and use.

If you weren’t able to build up the savings for it yet but for some reason you absolutely need to make that big purchase right now, you can consider taking a personal loan to pay for it (instead of using a credit card). As mentioned above, the lower interest rates make personal loans much easier to deal with and manage compared to credit cards. And it’s not just the lower interest rates that are an advantage—taking a personal loan can actually aid you in planning out your finances better because of something called a loan tenure.

In essence, a loan tenure refers to the time horizon you’re given to pay back your loan in full. Your loan tenure could be 12 months, 36 months, or even longer. Knowing how long your repayment period will be is going to be helpful as you plan out your monthly budget and finances and will help you complete your repayment with as little trouble as possible.

Note that there may be the option of changing your tenure if circumstances change and you suddenly can’t finish making repayments in the agreed amount of time. But extending your loan’s tenure will come at a price and not all banks offer such flexibility, so make sure that you are confident that your finances can handle the added debt obligation.

If you anticipate that you’ll have cash flow issues once you make the big purchase or if you’re unable to save up in time for any reason at all, a personal loan will allow you to redirect your efforts towards charting your expenses with more visibility once you’ve determined the monthly repayment amount. But of course if you can, it’s always best to pay upfront with your hard-earned savings.