Managing personal finances can be a daunting task, but with the right tools and apps, you can simplify your financial life and save more money.

Here's a handy guide to some of the best personal finance tools and apps available in Singapore – split into six categories.

Category 1: Track your expenses

Tracking your expenses is the best way to take control of your financial future and see where your money is going.

Dobin

Dobin is a fantastic expense-tracking tool that consolidates your financial data across multiple bank accounts into one user-friendly app.

It automates expense categorisation, tracks cash flow, and provides insights into your spending habits.

With Dobin, you can monitor trends, set budgets, and even receive personalised offers based on your spending patterns. It's like having a financial advisor in your pocket! Plus, it’s not tied to any financial institution, so you get unbiased recommendations tailored to your needs.

Wally

Wally is a comprehensive personal finance app that excels in expense tracking and budget management. It allows users to categorise their expenses, set budgets, and view detailed financial reports.

With features like receipt scanning and multi-currency support, it’s perfect for those who need to manage their finances across different countries. The app also includes a financial calendar to help users schedule bill payments and avoid late fees, ensuring a thorough and organised approach to personal finance management.

Category 2: Earn rewards

Don’t miss out on free money. If you are buying it anyway, try not to leave any cash on the table by earning rewards, collecting points and pocketing any cashback.

ShopBack

ShopBack is a cashback rewards platform that partners with numerous retailers to give you cashback on your purchases.

Whether you're shopping online or in-store, ShopBack helps you save money on everything from travel bookings to everyday groceries. Simply shop through the ShopBack portal or app and earn a percentage of your spending back in cash.

HeyMax

It is a rewards tool that aggregates various loyalty programs and promotions, making it easier for you to maximise your rewards.

By linking your credit cards and loyalty programs to HeyMax, you can keep track of your points, discover new offers, and ensure that you are always getting the best deals available.

Category 3: E-wallets

Even more free money!

GrabPay

GrabPay is a versatile e-wallet that allows you to pay for a wide range of services, from ride-hailing and food delivery to in-store purchases.

You can link your credit or debit cards to GrabPay or top up your Grab wallet to earn GrabRewards points on every transaction, which can be redeemed for discounts or free services within the Grab ecosystem.

FavePay

FavePay is another popular e-wallet in Singapore, especially known for its attractive cashback offers at numerous F&B outlets and retail stores.

With FavePay, you can enjoy seamless payments with GrabPay or your cards and earn instant cashback on your purchases, which can be used for future transactions.

Category 4: Banking apps with SGFinDex

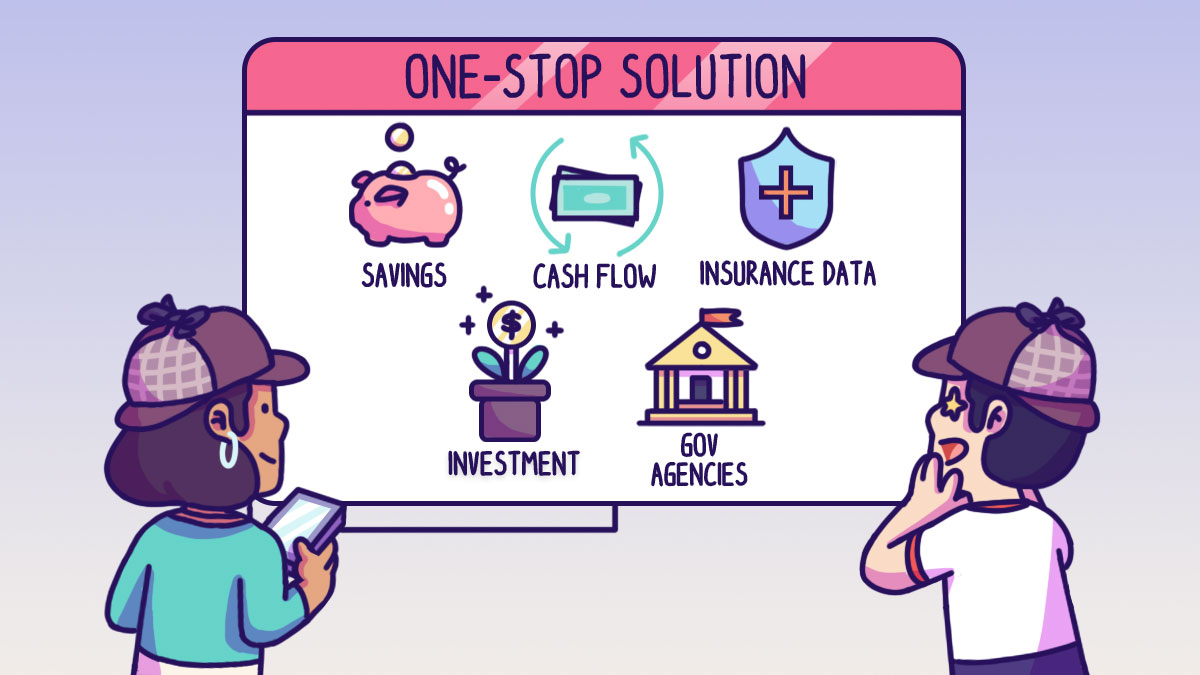

The Singapore Financial Data Exchange (SGFinDex) is a comprehensive platform providing individuals secure access to their financial information held across different government agencies and financial institutions.

It’s the world's first public digital infrastructure to use a national digital identity and centrally managed online consent system.

DBS Nav Planner

DBS Nav Planner is a financial planning tool that integrates with SGFinDex, allowing you to pull financial data from various bank accounts and government agencies. This gives you a holistic view of your finances, including savings, investments, and insurance. With its intuitive interface, you can set financial goals, track your progress, and receive personalised advice to achieve your financial objectives.

OCBC Financial OneView

OCBC Financial OneView offers similar capabilities, providing a consolidated view of your financial portfolio. It helps you manage your finances more effectively by giving you insights into your spending, saving, and investment habits.

You can also use it to plan for future financial needs, such as retirement or buying a home.

Category 5: Set a savings goal

These apps will help you save and therefore plan for your financial future.

Hugosave

Hugosave is a unique app designed to help you save money effortlessly. It rounds up your everyday purchases to the nearest dollar and saves the spare change in a Hugosave account.

Over time, these small amounts add up, helping you build a substantial savings fund with minimal effort. Hugosave also offers insights into your saving habits and helps you set and achieve specific financial goals.

Category 6: Multi-currency lifestyle requires a travel wallet to match

Travel overseas without fussing over fiat and lock in the exchange rates you want.

YouTrip

YouTrip is a multi-currency travel wallet that offers competitive exchange rates and supports over 150 currencies. It allows users to manage and exchange currencies directly within the app, ensuring you get the best rates when travelling or shopping online.

The YouTrip card, which can be used anywhere Mastercard is accepted, offers the convenience of overseas spending without additional fees and the benefit of locking in favourable exchange rates for future use.

It is also backed by robust security measures and is licensed by the Monetary Authority of Singapore (MAS).

This content is part of the Temasek – Financial Times Challenge, a financial literacy education series in Singapore for youths.